Comprehensive Credit Counselling Services with EDUdebt in Singapore

Comprehensive Credit Counselling Services with EDUdebt in Singapore

Blog Article

Exactly How Credit Score Therapy Can Transform Your Financial Future: Techniques for Achieving Stability

Debt counselling presents an organized approach to economic management, using individuals the devices required for sustainable financial security. The journey to financial stability entails even more than just preliminary strategies; it needs recurring commitment and understanding of the broader implications of financial choices.

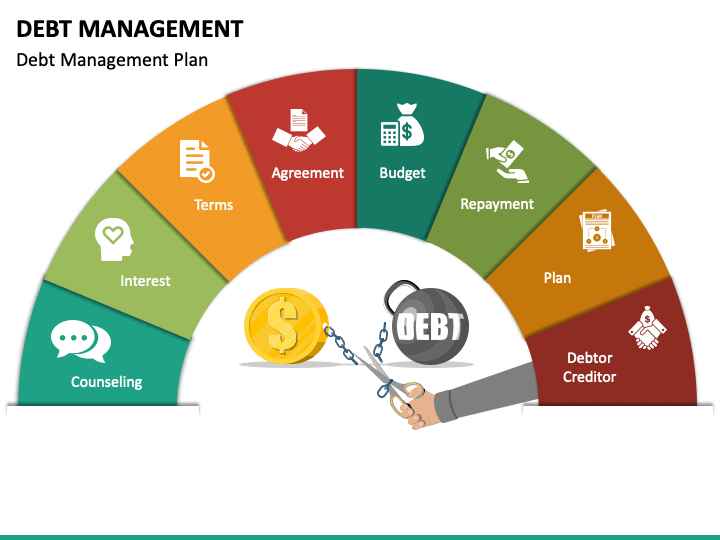

Understanding Debt Therapy

Counselling sessions generally cover necessary subjects such as recognizing credit scores reports, acknowledging the ramifications of numerous financial obligation types, and determining efficient payment methods. By promoting a notified viewpoint, credit counselling helps individuals make audio economic choices.

The objective of credit scores therapy is to gear up individuals with the tools essential to browse their economic scenarios efficiently. As an aggressive procedure, it motivates clients to embrace healthier financial habits and impart a feeling of responsibility. Eventually, credit score coaching serves not only as a means of dealing with immediate economic concerns but additionally as a structure for long-lasting financial health.

Advantages of Credit Report Therapy

Taking part in credit therapy offers various benefits that expand past instant financial debt alleviation. One of the main benefits is the growth of a tailored monetary plan customized to an individual's one-of-a-kind scenarios. This plan usually consists of budgeting techniques and approaches to manage expenditures a lot more effectively, cultivating financial proficiency and discipline.

Additionally, credit therapy provides accessibility to trained experts that can provide experienced recommendations, aiding people recognize their credit score reports and scores. This expertise empowers clients to make enlightened decisions regarding their financial resources and promotes responsible credit history use in the future.

Another substantial benefit is the possibility for reduced rates of interest or bargained settlements with lenders. Credit counsellors commonly have established partnerships with lenders, which can result in extra favorable terms for clients, reducing the worry of payment.

In addition, credit report coaching can play an essential function in emotional wellness. By attending to economic concerns proactively, people can minimize anxiety and stress and anxiety connected with frustrating financial obligation, causing an enhanced total lifestyle.

Eventually, credit report therapy not only aids in accomplishing temporary monetary relief but also equips people with the devices and understanding required for long-term financial security and success.

Trick Methods for Success

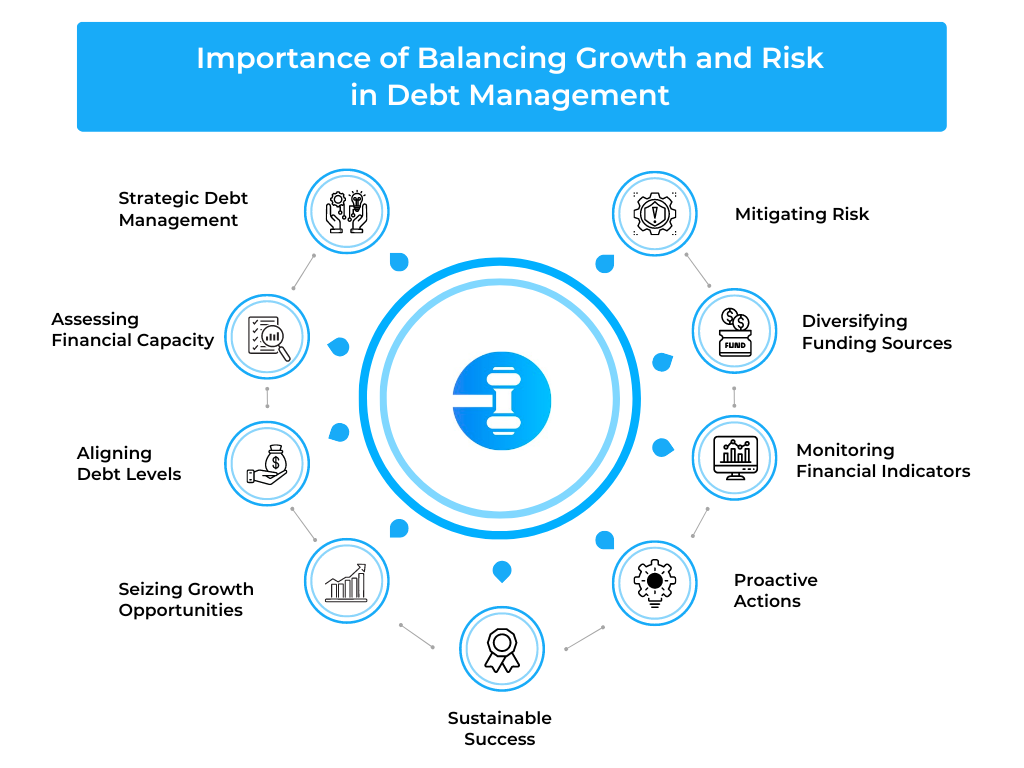

Accomplishing monetary stability calls for a critical technique that includes various key components. Initially, it is important to produce a detailed budget that accurately mirrors earnings, expenses, and cost savings goals. This spending plan offers as a roadmap for managing funds and enables individuals to identify locations for improvement.

Secondly, prioritizing financial debt payment is essential. Strategies such as the snowball or avalanche techniques can effectively lower financial obligation burdens. The snowball approach focuses on repaying smaller sized financial obligations initially, while the avalanche approach targets higher-interest debts to minimize general interest check this site out expenses.

In addition, building a reserve is important for economic safety and security. Alloting 3 to 6 months' worth of living costs can provide a buffer versus unexpected conditions, decreasing dependence on debt.

Furthermore, continual financial education plays a substantial role in successful credit score counselling. Staying notified concerning financial items, rate of interest, and market patterns equips people to make far better financial decisions.

Picking the Right Counsellor

Picking a certified debt counsellor is a crucial action in the journey toward economic security. Started by investigating counsellors associated with trusted organizations, such as the National Foundation for Credit Rating Therapy (NFCC) or the Financial Therapy Organization of America (FCAA)

Following, examine the counsellor's credentials and experience. Search for certified specialists with a strong performance history in credit scores counselling, debt monitoring, and financial education and learning. It is necessary that the counsellor demonstrates a comprehensive understanding of your details requirements and challenges.

Furthermore, consider their method to coaching. An excellent credit report counsellor ought to prioritize your economic goals and offer individualized techniques as my review here opposed to one-size-fits-all services. Timetable a preliminary appointment to assess how comfy you really feel discussing your economic situation and whether the counsellor's interaction style aligns with your assumptions.

Lastly, inquire about charges and solutions offered. Openness in prices and a clear understanding of what to anticipate from the therapy procedure are vital in developing a trusting partnership.

Maintaining Financial Security

Maintaining monetary security needs continuous dedication and positive monitoring of your funds. This involves routinely evaluating your earnings, expenditures, and savings to guarantee that your monetary techniques straighten with your long-term goals. Establishing a detailed spending plan is a fundamental step; it offers a clear image of your financial health and enables you to determine areas where modifications might be essential.

In addition, producing an emergency fund can function as an economic buffer against unforeseen expenditures, thus stopping reliance on credit report. Goal to conserve a minimum of three to 6 months' well worth of living expenditures to improve your monetary safety and security. On a regular basis my website examining and adjusting your spending behaviors will also cultivate self-control and accountability.

Furthermore, checking your credit score report and addressing any kind of inconsistencies can significantly influence your monetary security. A healthy credit report not only opens up doors for much better car loan terms yet likewise mirrors accountable financial habits.

Conclusion

In recap, credit coaching functions as a pivotal source for individuals looking for to improve their financial security. By offering tailored approaches and skilled guidance, it cultivates a much deeper understanding of budgeting, debt monitoring, and credit report awareness. credit counselling services with EDUdebt. Applying the methods found out through coaching can result in lower financial stress and anxiety and boosted confidence in handling individual funds. Eventually, the transformative potential of debt therapy depends on its capacity to furnish individuals with the tools necessary for lasting financial success.

The trip to economic stability involves more than just preliminary methods; it needs recurring dedication and understanding of the broader implications of financial decisions.The goal of credit score coaching is to outfit people with the devices essential to browse their economic scenarios efficiently. Inevitably, credit rating counselling serves not just as a method of addressing immediate economic problems yet additionally as a structure for lasting monetary health.

Keeping monetary security requires continuous commitment and proactive administration of your financial sources.In summary, credit report therapy serves as an essential resource for people looking for to improve their monetary stability.

Report this page